Frequently asked questions about setting up a limited company

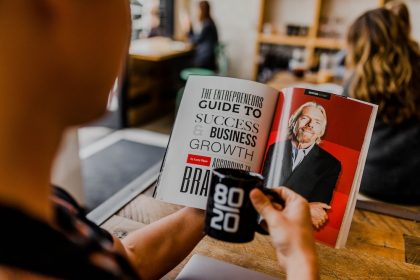

Making the proactive choice to set up a limited company can be one of the most exciting stages of a business person’s life.

Being the owner of your own business is the main goal of many hardworking employees and sole traders. And while there’s a lot to consider before that all-important next step, this is a momentous occasion that deserves to be celebrated.

However, before you make your next move towards future success and glowing reviews on Checkatrade, you’ll inevitably have a lot of questions and concerns about setting up a limited company.

What is a limited company?

A limited company is essentially a completely separate thing from the owner of that company. In other words, if a limited company experiences financial difficulties or a legal battle, the company itself is liable, and not the owner of that company.

This kind of company is a lot different from being a sole trader, where the liabilities of a business rest on the owners’ shoulders.

Can I set up a limited company?

Absolutely anyone of any nationality is legally allowed to set up their own limited company as long as they meet 3 main criteria:

- They aren’t subject to any UK government restrictions

- They haven’t been restrained via court order

- They aren’t an undischarged bankrupt

You don’t need to live in the United Kingdom but the registered office address of your limited company will need to be in England, Wales, Northern Ireland, or Scotland.

Is setting up a limited company expensive?

Many people like the sound of starting up a limited company but assume it’s a costly process. However, it’s far more cost-effective than you think.

All you really have to do is register your company with Companies House. How much does doing this set you back? Just £40 by post, or £12 to get registered online.

Does a limited company pay less overall tax?

Taxes are an inevitability in all walks of business, whether you’re a limited company, an employee, or a sole trader. But when it comes to paying less overall, you won’t be required to pay income tax or national insurance (depending on the salary you earn).

However, you will be required to pay corporation tax, which tends to be less than other standard taxes. In other words, yes, taxes still exist, but you will pay a little less than usual.

If I start a limited company, how do I pay myself?

Like any business venture, starting your own limited company will have an effect on your finances. Especially when it comes to paying yourself in this new venture.

There are two main ways you can pay yourself when you’ve set up a limited company – by salary or by dividends.

A salary can simply be transferred on a monthly basis from the company account to yours. This salary is subject to income tax and national insurance if it’s over a certain set amount. Dividends can be taken from the company profits after all necessary taxes have been paid.

Photo by Daria Pimkina