Are we seeing the downfall of MLM Forever Living’s top managers?

We’ve been following the very public fortunes of Forever Living’s top managers for a few years now. And it looks like some of their careers are in an unstoppable downfall.

Un-coincidentally, this downfall has coincided with what appears to be the terminal decline of the MLM industry as a whole. Even the DSA’s own figures show a dramatically shrinking industry. And as long term critics of network marketing, we could not be happier to see it disappear forever.

So why do we believe the fortunes of MLM Forever Living’s top managers (and, seemingly, Forever Living UK itself) are fading? Let’s look at some of the evidence.

The Forever Living manager who couldn’t repay her debts – despite being chased by solicitors

One Forever Living ‘Sapphire Manager’ describes herself as a “Global Business Coach and Trainer who helps people achieve their best personally and professionally”.

Over the years she has been frequently rolled out by Forever Living to train and give inspiring talks at rallies and events, as an example of a success story. However, during this time she was hiding a big secret from the people who looked up to her: she owed HMRC an eye-watering amount of money, and could not pay her debt.

In total, her business owed £183,236:

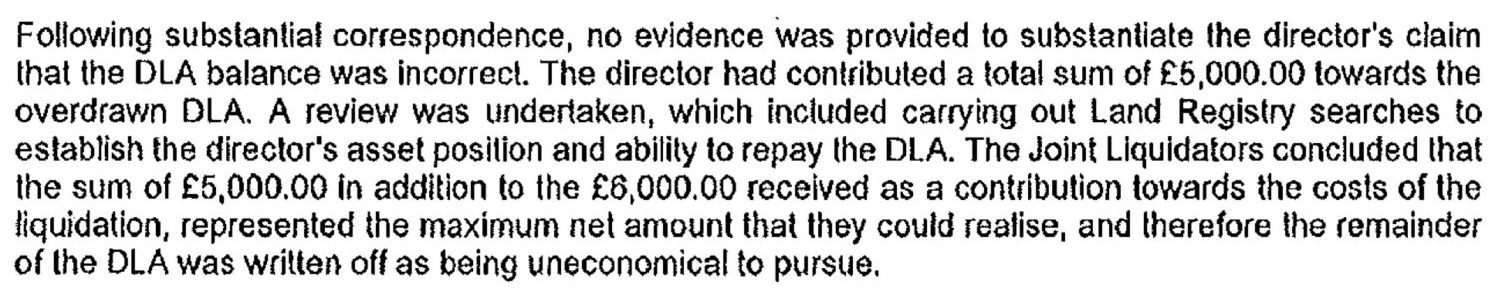

A large amount of this was for a director’s loan – money a director borrows from the company tax-free. This money must either be repaid, or tax paid on it, neither of which this Forever Living manager did. When she attempted to close down her company, liquidators were appointed in an attempt to recover the debt from her.

They apparently agreed a payment plan with her but, despite her publicly collecting a bonus cheque from Forever Living during that time, she seemingly reneged on the agreement. Eventually the liquidators decided that, after examining her financial assets it was “uneconomical to pursue”:

How embarrassing for this ‘success story’. Her business owed almost £200,000, but she had so few financial assets it was deemed pointless to pursue her for any part of the money.

Not that this woman appears to have any shame. While this was taking place, she was boasting on Facebook about eating out in restaurants, going on staycations and getting her hair done, and busy trying to recruit more people to her team.

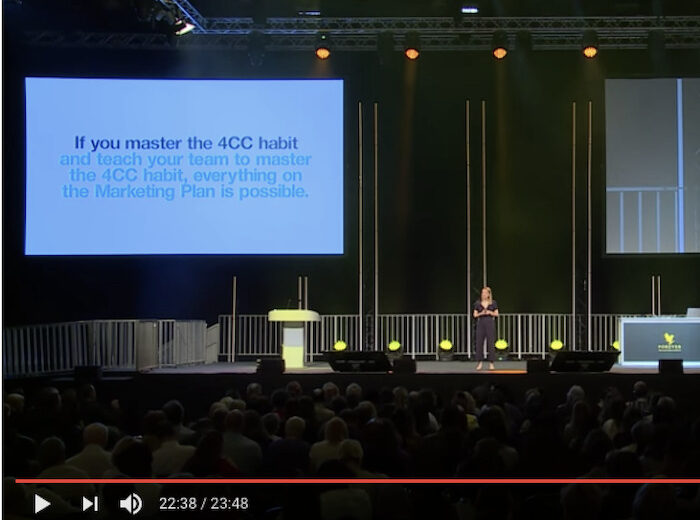

She was also on stage at a Forever Living event, teaching people how to make a success of the business, while her company was in liquidation:

For us this is yet more evidence that you can’t trust a word that an MLM company or their reps say.

The Forever Living manager ‘living like royalty’ who was bankrupt two years later

Not that this woman was the first (or last, we suspect) Forever Living manager to end up with debts they can’t repay.

Here’s another top Forever Living Manager in her heyday, collecting a large cheque on stage:

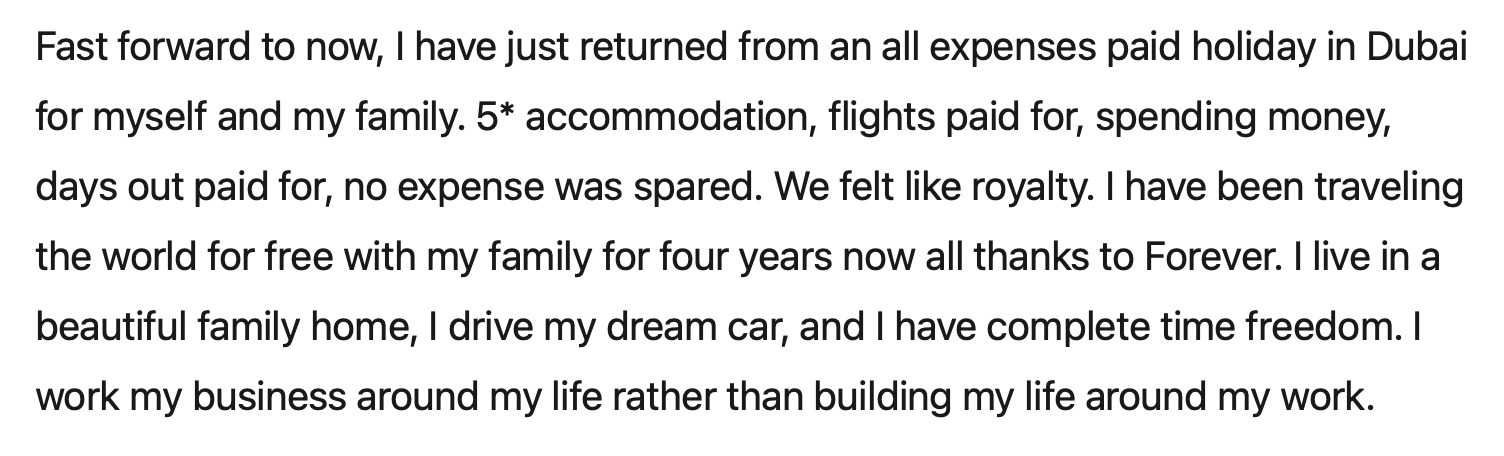

And here’s what she said in 2017 of the lifestyle Forever Living afford her and her family at that time:

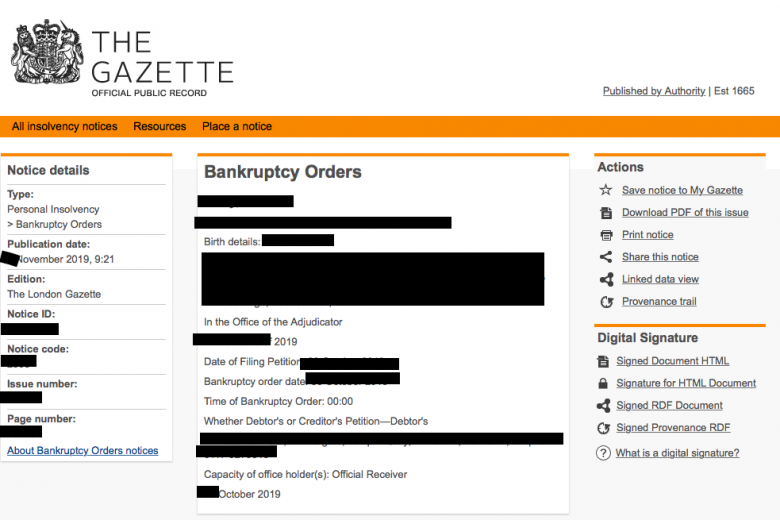

Sounds pretty aspirational, doesn’t it? Roll on just two years though, and this woman is paying a pretty heft price for living the high life. As you can see, by 2019, she was bankrupt:

That’s a pretty significant come-down, but not unexpected in an industry that requires you to maintain the illusion you have a luxury lifestyle. It’s not uncommon to see MLM reps build up large debts in order to try to convince their downline they are rich.

The “debt-free” Forever Living manager with a massive loan she can’t repay

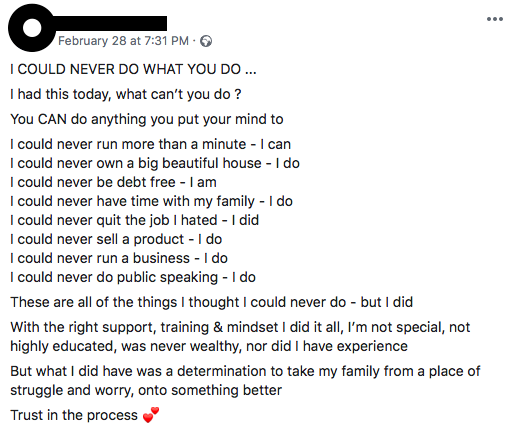

The perfect example of this is another top Forever Living manager who continually boasts about her ‘enviable’ lifestyle, and overtly uses these boasts as an attempt to recruit victims to her downline.

This woman can often be seen on social media claiming to be debt-free:

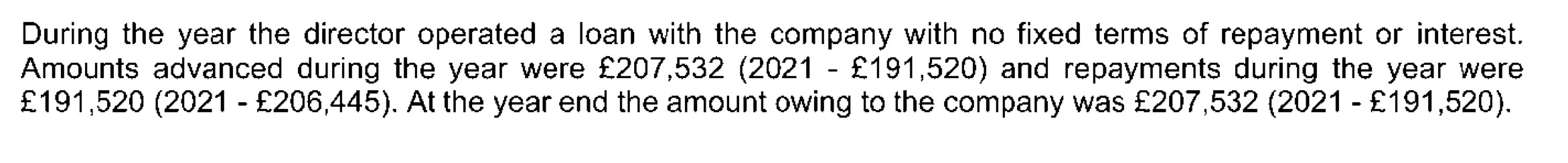

However, as well as a mortgage on her home, she owes an enormous amount of money to her company:

As you can see, she currently owes her business £207,532 in the form of a director’s loan. As already mentioned, this needs to be repaid within nine months of the end of her accounting period. If not, she needs to pay 32.5% tax on it.

This Forever Living manager has increased the money she owes her company since she first took out her director’s loan in 2016:

- 2016: £109,844

- 2017: £188,377

- 2018: £189,175

- 2019: £205,180

- 2020: £206,445

- 2021: £191,520

- 2022: £207,532

Clearly she is unable to repay this money, or pay the tax due on it. Instead she looks to be ‘bed and breakfasting’ her director’s loan, or finding a way to get around it, while still, in effect achieving the same aim – avoiding paying the tax that is due on what looks to us like an ongoing loan.

One thing is clear: this woman is not debt-free. And she is apparently unable to repay her debt as her business has shrunk considerably since the heyday of MLMs.

Like many other Forever Living managers, this woman took out her director’s loan in the years when she was collecting big bonus cheques on stage. But she’s failed to collect any cheque in the last few years, and last year received just a modest-sized cheque.

This is a clear indication that her business has dwindled away, as the bonus cheques are based on the amount of business you and your team do throughout the year.

Despite this woman’s boastful social media presence, it is clear that she is struggling financially, and will at some point need to face up to the reality that, like the woman whose business went into liquidation, she seemingly owes HMRC money she can’t repay.

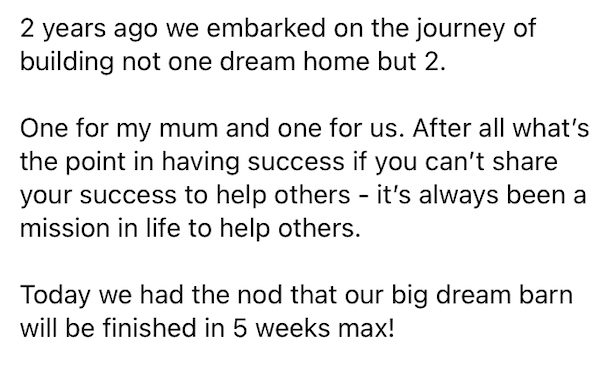

The Forever Living manager who is having to sell her dream home

Yet another Forever Living manager who has hit hard times is having to sell her dream home. Though in typical MLM-style is trying to spin it as if it’s a good thing.

Here she is in 2018, speaking about the dream home she built:

And here she is at the end of 2022, talking about buying a new property:

Clearly we weren’t the only ones surprised that she was moving so soon:

While this Forever Living manager tries to spin this move as a good thing, the facts indicate otherwise. She’s buying a home almost half the value of the one she is selling, much smaller (despite what she claims) and far less lovely, so it’s absolutely not a move up, or even sideways.

She is also hiding some financial secrets from her social media followers. Her husband’s business went into liquidation in 2019 owing £146,065. And a new business he’s since started (amusingly, it’s a financial consultancy) had just £19 in the bank when filing its 2022 accounts.

Meanwhile, her own company accounts have dwindled dramatically since the glory years of MLM, and her last accounts show that her business owes the bank £35,000.

Despite this woman claiming on social media recently that she took two years off from her business and “my income just carried on growing”, it is clear that she is struggling financially… to the point she needs to sell her home and downsize dramatically.

The Forever Living manager whose bonuses have plummeted, but still has a large director’s loan

Another top UK Forever Living Manager also has a large director’s loan she appears unable to pay back. Here’s what she has borrowed from her company over the past few years:

- 2017: £331,746

- 2018: £753,802

- 2019: £545,688

- 2020: £290,857

- 2021: £243,683

As you can see, she is chipping away at it where she can, but is clearly unable to clear the loan. That’s probably because her income has plummeted since she took out her first director’s loan. Here are the bonuses she has earned over the years:

- 2015: $682,012

- 2016: $1,007,066

- 2017: $677,108

- 2018: $430,108

- 2019: $457,593

- 2020: No cheque?

- 2021: $153,228

In 2020 she declined to share the value of her bonus. We suspect this was either because she failed to earn a bonus that year, or it was so low that she was too embarrassed to reveal it. Certainly the downward trend in amounts points to her not receiving a large bonus, if she received anything at all.

There’s an interesting pattern we see with almost all of the top Forever Living managers in the UK. Between 2015 and 2017, the company was doing well, and they were earning big bonuses. Clearly feeling confident the money would continue to come in, they withdrew large sums of money from their businesses as tax-free director’s loans, and bought large houses.

However, as we now know, the money did not keep coming in at that level, and it looks like they were unable to repay their director’s loans. So they were forced to carry them over, year after year. Some chipped away at the loans where they could, while others increased theirs as they struggled to maintain the enviable lifestyle required to lure in new recruits.

Interestingly, all these Forever Living managers use the same accountancy firm, which happens to be based close to the Forever Living UK headquarters. And somehow this firm has enabled them to carry over their director’s loans, without being penalised for bed and breakfasting which, in our opinion, they are doing.

As we’ve already explained, a director’s loan must be repaid within nine months of the end of the company’s accounting period. If not, the company must pay 32.5% tax on it. A director must then wait 30 days before taking out another loan.

The only way, as far as we can see, the Forever Living managers have managed to keep rolling over such large loans were if they were somehow repaying them and then re-borrowing 30 days later. But it is clear they have not had the funds to do this, otherwise why keep borrowing again?

The only answer to this that we can see is that someone was lending them the money (and continues to do so) to bridge that 30 days, or the accountancy firm somehow found a way around this rule.

What is clear to us, is that these women bought lifestyles they could not afford, with money borrowed from their business tax-free; money most have failed to pay back.

Sadly, this manager has recently been forced to put her “dream home” on the market too.

The Forever Living manager whose company is being shut down with massive debts

And finally, one of Forever Living’s most well-known former managers, who has walked on stage to collect lottery-sized cheques has suffered probably the biggest fall of all – not that you would know it from social media.

At the height of her success, this woman earned a bonus cheque of $490,897. But like many Forever Living managers, she didn’t appear to invest or spend this wisely. Instead, she took out a director’s loan of over £400,000, which she only paid back (which seems a little too coincidental to us) when her parents sold their large house. (Her parents now live in her garden.)

Meanwhile, her business accounts in 2022 showed that her business’ liabilities were greater than its assets. In accounting terms, this means her company is insolvent.

She also owns another business, in partnership with another Forever Living manager, which sells diaries and notepads. This company has been issued its First Gazette for compulsory strike off after failing to submit accounts last year.

Interestingly this company also has an outstanding director’s loan of £72,724. There are “serious implications” if you do not repay a director’s loan and your company goes into liquidation. This does not look good for either woman.

However, none of this has stopped this former Forever Living manager from setting up an online business selling the secrets of making seven figures with another woman, who has a poor reputation online for allegedly scamming people. We’re not sure what either woman can possibly teach anyone about good business practices!

If these women can’t make MLM work, no one can

None of the women in this article are small fry in the world of MLM. Indeed, according to the woman who claims to be debt-free:

These women – while not (despite the ridiculous claim above) the most successful independent owners in the UK or Europe – are some of the top Forever Living managers in the UK. And if they can’t make MLM work now the brief glory years have passed, no one can, in our opinion.

Read more about the MLM industry

If you’d like to learn more about MLMs, and why we believe they are so harmful, we recommend reading these articles:

- The 10 ugly truths MLMs don’t want you to know

- Is it REALLY possible to make money in an MLM? We do the sums

- Are MLMs really pyramid schemes? Why you can’t make money selling their products

- Seven lies an MLM rep will tell you – and the REAL truth you need to know

We also recommend reading the experiences of some of the former MLM reps we have interviewed here:

- What’s it REALLY like as an MLM rep? We interview one to find out

- Thinking of joining an MLM like It Works? Read this cautionary tale first

- How much can you earn as an It Works distributor? How one woman lost £3,239

- Look into the bad reviews… then run!” One former rep shares her experience with MLM It Works!

- The complete lowdown on MLM Juice Plus+ and how it cost one woman £68 a month

- How much can you earn with MLM Valentus? And how even the company admits that ‘most reps’ lose money

- Why MLMs like Younique apparently don’t even work for the top reps

Hannah Martin is a media expert on multi-level marketing (MLM). She’s been investigating MLMs since 2016 and has appeared on the BBC’s Woman’s Hour speaking about MLMs.

She was on the steering committee for the world’s first global MLM conference and has helped journalists and TV producers create investigative content into the MLM industry, including the BBC documentary Secrets of the Multi-Level Millionaires: Ellie Undercover.

Photo by Ali Karimiboroujeni