“The median earnings were $0.00” – what the 2020 LuLaRoe income disclosure statement reveals about the ‘opportunity’

How much can you earn in an MLM like LuLaRoe? To find out, we looked at LuLaRoe’s 2020 income disclosure statement – and were sadly unsurprised by the depressing numbers.

As part of their 2021 settlement with Washington State, US clothing MLM LuLaRoe must produce annual income disclosure statements showing how much their Retailers earned. In this article we’ll look at LuLaRoe’s 2020 income disclosure statement, and explore what it reveals.

(Find out here why the shocking numbers you are about to see haven’t stopped LuLaRoe recruiting!)

Why did Washington State file a lawsuit against LuLaRoe?

But first, why was there a lawsuit against LuLaRoe? In January 2019, Washington Attorney General Bob Ferguson filed a lawsuit against LuLaRoe and several of its executives, asserting that the defendants made unfair and deceptive misrepresentations regarding the profitability of being an Independent Retailer for LuLaRoe.

Examples cited by Ferguson include:

- “So many of our retailers are making amazing money doing this part time.”

- “A huge number of people” sell $15,000 to $20,000 each month.

- LuLaRoe has “a bunch of people” that can sell up to $150,000 per month.

- LuLaRoe “is a crazy and incredible opportunity for you.”

However, instead of making money, many of LuLaRoe’s Independent Retailers say they were left with debt and unsold merchandise they could not return without taking a loss.

Ferguson’s lawsuit claimed that LuLaRoe violated the Washington Antipyramid Promotional Scheme Act and the Consumer Protection Act. And as well as LuLaRoe’s “deceptive misrepresentations regarding profitability”, Ferguson’s lawsuit challenged LuLaRoe’s “unlawful bonus structure and unfair refund policy”.

Ferguson said of the case: “LuLaRoe tricked Washingtonians into buying into its pyramid scheme with deceptive claims and false promises. As a result, thousands lost money and two individuals made millions from their scheme. Washingtonians deserve fairness and honesty – and accountability for those who don’t play by the rules.”

What was the settlement between Washington State and LuLaRoe?

Under the terms of the resolution in February 2021, LuLaRoe was required to pay $4.75 million to the Attorney General’s Office. Ferguson would then use $4 million of this payment to provide restitution to LuLaRoe retailers from Washington. The Attorney General’s Office estimated that around 3,000 Washingtonians would receive checks.

As well as paying $4.75 million, LuLaRoe was required to:

- Publish an income disclosure statement that accurately details retailer income potential.

- Calculate bonuses based on retail sales, not on the amount of merchandise purchased by independent retailers.

- Conduct random and targeted audits to determine whether sales are to genuine consumers, rather than an effort to manipulate the compensation system.

- Allow new retailers to return all inventory for a full refund, including shipping costs, within 45 days of becoming a new retailer.

- Return inventory not eligible for a refund to the retailer.

- Prohibit certain types of deductions from refund requests.

- Warn retailers when the inventory they are purchasing is seasonal or otherwise does not qualify for return and refund.

What does LuLaRoe’s 2020 income disclosure statement say?

So what is in LuLaRoe’s 2020 income disclosure statement? Let’s take a look.

At the start, LuLaRoe point out that their disclosure statement contains information regarding the gross profits of any Independent Retailer who processed a transaction at any point in the year 2020, whether that was a wholesale purchase or a retail sale.

Gross profits in this instance include five components:

- Wholesale purchases directly from LuLaRoe

- Retail sales

- Wholesale purchases from other Retailers

- Wholesale sales to other Retailers

- Earnings from the Leadership Compensation Plan

Gross profits doesn’t take into account business expenses, so it’s important to remember that the amounts LuLaRoe share aren’t actually money in the pockets of Retailers. At the end of their income disclosure statement LuLaRoe list (as is required in their agreement with Washington State) some of the expenses retailers need to deduct from the money they make. These include:

Startup costs

- Racks

- Hangers

- Storage bins

- Mannequins

- Online sales equipment (camera, internet, computer/mobile phone)

- Printer for shipping labels

- Home office/warehouse

- Vehicle/trailer to transport merchandise

- Business cards

Ongoing costs

- Shipping

- Packaging

- Advertising (both traditional and online)

- Promotional giveaways

- Travel expenses (vehicle, mileage, gas)

- To attend corporate events

- To attend training

- To host pop-ups

- To deliver orders

- Employees or assistants

- Insurance

Professional services

- Accountant

- Attorney

- Bookkeeper

LuLaRoe say that these expenses “can be several hundred dollars or thousands of dollars annually.” It’s important to bear this in mind when you look at how little Retailers are earning before these expenses need to be deducted.

How much profit did LuLaRoe Retailers make in 2020?

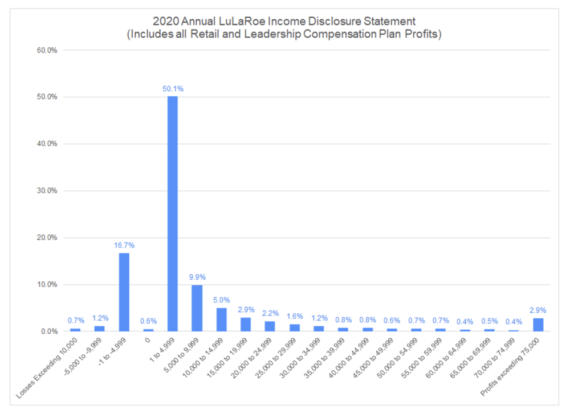

According to LuLaRoe, this chart shows the combined total of retail sales, wholesale sales to other Retailers, and earnings from the Leadership Compensation Plan minus the combined total of wholesale purchases from LuLaRoe and from other Retailers:

For the year 2020, the average Retailer gross profit was $10,073.41 while the median gross profit was $1,444.65. So that’s a median gross profit of just $120 a month – before expenses.

More than 18% of LuLaRoe Retailers LOST money in 2020

Please also note that the table shows that 18.6% of all LuLaRoe Retailers retailers made a LOSS in 2020. 16.7% lost up to $4,999, 1.2% lost between $5,000 and $9,999 and 0.7% lost over $10,000.

And that is before deducting business expenses, which LuLaRoe themselves state can be “several hundred dollars or thousands of dollars annually”.

So LuLaRoe know that almost one fifth of the people who join their company may lose money, potentially a LOT of money, even before they deduct unavoidable business expenses, such as shipping.

What’s the difference between ‘average’ and ‘median’?

There’s one important thing we need to point out in LuLaRoe’s income disclosure statement – and this applies to any MLM income disclosure statement.

You notice they give two gross profit figures here: average and median. Why are the numbers different, and what do they mean?

Put simply, to find the ‘average’ (in this case ‘average’ is the mean average) you add up all the profit and then divide by the number of Retailers. The ‘median’, meanwhile is the middle profit. In finances, you usually use the median number as the average. The reason for this is you only need a couple of outliers – one or two big numbers – to skew the mean average (when you add up all the profit and divide by the number of Retailers).

Outliers like this example:

This is especially important in MLMs when research shows that an average of 99.6% of people will possibly lose money, and only 0.4% make a profit. The profit of that 0.4% is so large that it significantly influences the ‘average’ profit and makes it misleading, because very, very few of participants ever stand a chance of seeing any of the money that is included in the ‘average’ calculation.

This is why MLMs are so fond of mean averages – it inaccurately represents the actual distribution of money. A median average is a far more responsible way of showing what people are earning in an MLM as it shows a more accurate picture.

It’s for this reason that LuLaRoe were obliged to show the median average in their income disclosure statement, and as you can see it’s a far lower number than the mean average.

How many LuLaRoe retailers earned money from their compensation plan in 2020?

Almost every MLM requires their participants to make a specific value of sales (usually monthly or every three rolling months), or recruit a certain number of people underneath them, in order to qualify for their compensation plan. And we often see that over 80% of people actively working the business fail to meet this requirement.

LuLaRoe appears to be no different, stating that 85.38% did not receive any earnings through their Leadership Compensation Plan. This means that the mean average Leadership Compensation Earnings of all Retailers in 2020 was $1,235.97. And the median earnings, which is a more accurate reflection of most people’s experience? $0.00.

Yes, the median Leadership Compensation Earnings of all LuLaRoe Retailers in 2020 was zero. And don’t forget, they still need to deduct “several hundred dollars or thousands of dollars” in expenses. So in fact, the average Retailer didn’t make nothing – we believe, based on LuLaRoe’s own figures, that they lost money.

Even those who qualified for the plan (just 14.62% of all Retailers) didn’t earn much. The mean average earnings for the year under the Leadership Compensation Plan were $8,567.75. And the median earnings was $520.99 – or $43 a month.

Yes, of the 14.62% of Retailers who earned through the Leadership Compensation Plan, the average monthly profit was $43. And that’s before deducting “several hundred dollars or thousands of dollars” in expenses.

Here’s what the distribution of earnings to only those 14.62% of Retailers looks like (don’t forget, the 85.38% who earned nothing from it aren’t included here):

How much did LuLaRoe Retailers earn from retail sales in 2020?

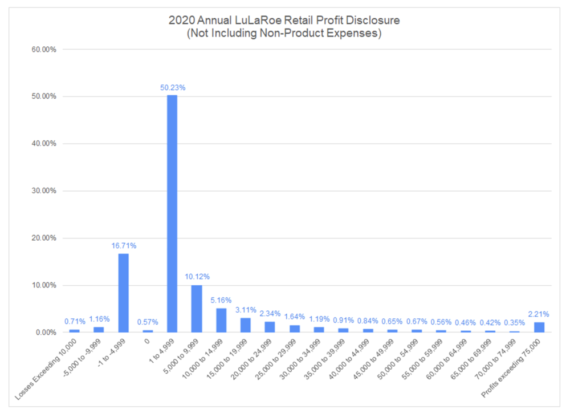

And what about retail profits alone? Here’s how much money LuLaRoe retailers made through retail sales (not including any earnings through the Leadership Compensation Plan):

LuLaRoe say that the mean average gross profit of a Retailer in 2020 was $8,837.44, and the median gross profit was $1,438.66 – or $119 a month. And again, Retailers need to deduct expenses from this, including shipping of products to customers.

Also once again, we’d imagine that based on these numbers, the average LuLaRoe Retailer is likely to have lost money.

More than 18% of LuLaRoe Retailers LOST money in 2020

Please also note from the chart above, that the graph also shows that 18.58% retailers LOST money even before deducting expenses. 16.71 lost up to $4,999, 1.16% lost between $5,000 and $9,999 and 0.71% lost over $10,000.

Again this is before subtracting business operating expenses, so the true loss for these people is likely to be much higher.

How do the REAL earnings compare to LuLaRoe’s claims?

The Washington State Attorney General filed a lawsuit against LuLaRoe partly because the claims they were making were irresponsibly and unethically (in our opinion) very far from the reality of the people who signed up to the company.

Let’s revisit some of those apparent claims:

- “So many of our retailers are making amazing money doing this part time.”

- “A huge number of people” sell $15,000 to $20,000 each month.

- LuLaRoe has “a bunch of people” that can sell up to $150,000 per month.

- LuLaRoe “is a crazy and incredible opportunity for you.”

Here’s LuLaRoe’s mission:

And some quotes from their website:

- “The innovative business model gives Independent Fashion Retailers the ability to set their own schedule, pace, and the opportunity to do what they love and profit from it as well.”

- “DeAnne is forward-focused, consciously striving to improve lives, while building a legacy for generations to come.”

- “The company provides families with the opportunity to work from home while raising their children; providing the freedom to set their own pace and schedule—and the confidence to become successful entrepreneurs.”

- “This opportunity has allowed many to live their best life in a way that best suits their goals and aspirations.”

Bear this in mind when you recall some of the numbers from LuLaRoe’s own income disclosure statement:

- 18.6% of all LuLaRoe Retailers retailers made a LOSS in 2020.

- The median Leadership Compensation Earnings of all LuLaRoe Retailers in 2020 was zero.

Let’s also take a moment to acknowledge how some LuLaRoe Retailers have described their experience with the company. Here is a quote from one former Retailer, shared in a Facebook group. Her words sum up what many women say they have experienced or felt about their time with and after LuLaRoe:

“#becauseoflularoe I am in more debt than I started with. #becauseoflularoe I am 2 years behind on my taxes and owe so much money that even their payment plan I can’t afford. #becauseoflularoe I am starting the bankruptcy process. #becauseoflularoe my house is for sale and will go into foreclosure if it doesn’t sell by the end of March.

“#becauseoflularoe my family is shattered and split. #becauseoflularoe my anxiety and depression is worse than ever and I now have been diagnosed with PTSD… #becauseoflularoe I am a broken person that looks in the mirror and feels I have no worth. #becauseoflularoe I am a broken person.”

We believe that the huge disparity between the lived reality of reps, and the marketing messages of MLMs like LuLaRoe, as well as the lies perpetuated by the uplines – the 0.4% who generally profit from the rest of the people in the company – is the cause of the huge psychological and emotional damage many, very sadly, experience in MLMs

Only 10.6% of LuLaRoe Retailers made more than a waitress in 2020

To discover just what “a crazy and incredible opportunity” LuLaRoe really is, let’s compare the earnings (BEFORE expenses) of their Retailers with what a waitress earns. The average salary for a waitress in the USA in 2019 was apparently $22,890.

According to LuLaRoe, only 10.6% of all Retailers earned over $25,000 in 2020. And again, to remind you, this is gross earnings and doesn’t include business expenses, including the cost of shipping products to customers. LuLaRoe themselves say that business expenses “can be several hundred dollars or thousands of dollars annually.”

So the true ‘income’ of that 10.6% who make more than a waitress on paper is likely to be much less. Or, to put it another way, it looks like you are likely (at least 90% more likely) to be better off getting a job as a waitress than you are joining LuLaRoe.

Want to know some of the history of the dramas surrounding LuLaRoe? Read our article here.

LuLaRoe’s income disclosure statement is sadly predictable

It’s rare that an MLM will produce an income disclosure statement voluntarily, like Tropic Skincare in the UK do. Often, when MLMs do produce them, it’s because they operate in a country that requires them, or they have been ordered by a court or legally binding agreement to produce them, like Amway and LuLaRoe.

And you can see why they are reluctant to share the truth about their businesses. Because the numbers are often the same: over 80% of people actively working the business earn no money from it. Which means, when you factor in expenses they have lost money.

And not just money. According to the UK DSA, 49% of MLM reps spend more than 10 hours a week trying to make the business work for them. So most of them will be working hard for free, or worse – working to LOSE money.

Even those who do earn money earn a pathetically small amount on the whole. It’s always the tiny top percentage who earn the headline-grabbing numbers (and as we reveal here, many of them aren’t as wealthy as they make out…).

That’s why experts like Robert FitzPatrick, author of Ponzinomics, state that the mean average earnings for people in most MLMs is zero. And why this research published on the FTC website calculates that, on average, 99.6% of people in an MLM will lose money once business expenses are deducted.

What changed in LuLaroe’s 2021 income disclosure statement? We spot two tiny but telling omissions here.

Read more about MLMs

You can read more about the MLM industry in these articles:

- The 10 ugly truths MLMs don’t want you to know

- Is it REALLY possible to make money in an MLM? We do the sums

- Are MLMs really pyramid schemes? Why you can’t make money selling their products

- Seven lies an MLM rep will tell you – and the REAL truth you need to know

Photo by Kat J